ONLY $9.63 For This Wealth Guide

Learn Expert Financial Insights in just 3 minutes a Day

NO progress in 30 days? I'll refund every penny and/or give you a free 30 minute consultation*

**You Won't find these insights on social media—because REAL wealth-building isn’t about trends or viral hacks. It’s about time-tested strategies from true financial experts.

Is anyone else tired of Social Media Influencers dishing out the same cookie-cutter advice?

In 2020, as the world was shutting down, I made the bold decision to leave a high-paying career as a financial professional, earning around $200,000 a year, to pursue something more meaningful. I was tired of seeing the best financial advice reserved only for "High Net Worth" investors while others were left behind.

Day 1 of 369 Financial: A dream turned reality.

2020: Just me, in PJ bottoms, crafting investment strategies that set the foundation for 369 Financial. Humble beginnings, big goals.

Building my business wasn’t easy—and it shouldn’t be. During the shutdown, while others chased viral content, I focused on what truly matters: creating smart financial strategies for my clients. Financial markets evolve constantly, and if you’re not growing with them, you’re falling behind. I’m here to help you stay ahead.

"Everything started to shift in 2022. The stock market was struggling, and many people were panicking. But in times of chaos, it’s critical to stay focused on the long-term goal. While others let fear take over, I saw opportunity—and that mindset made all the difference

In 2022, I was sketching out the concept for the Never Broke Again Wealth Guide. It’s been a journey, but great things take time—and I’m proud to finally share it with you!

9 stands for philanthropy—and I believe giving back is essential. Speaking to future finance leaders is one way I strive to inspire others to build wealth not just for themselves, but to make a difference in the world.

I’ve had the privilege of speaking to finance students at universities about building wealth and launching an investment firm in today’s competitive landscape.

Competing with billion-dollar companies is no small feat, but with the right strategy, focus, and determination, success is within reach.

I don’t live in a mansion or drive an exotic car—and that’s okay. What matters to me is helping people take control of their financial future, build lasting wealth, and create the life they’ve always dreamed of. Empowering others to grow and thrive is the greatest success I could ever achieve.

That’s why I made this guide affordable—for anyone ready to take their first step toward financial freedom.

This is me, in the last week of 2024, working on 369 Financials' Annual Letter.

Debunking the Myths: Misleading Money Advice from Social Media Influencers

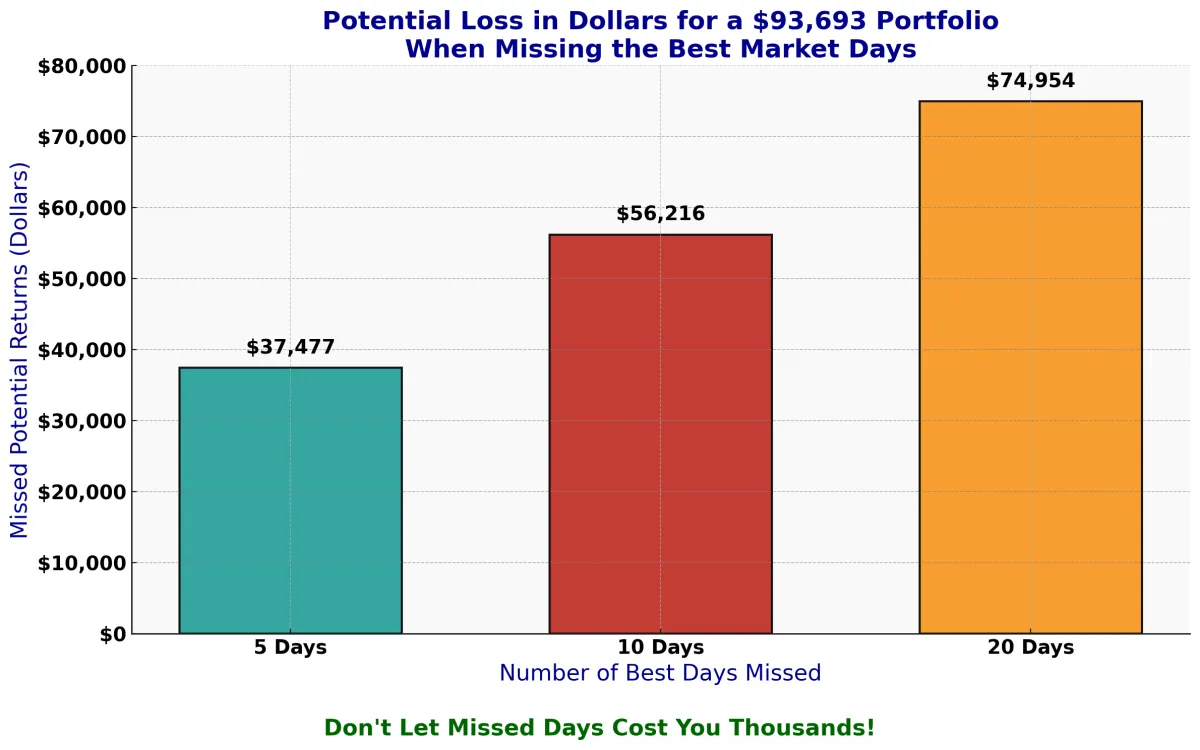

Money Myth #1: Day Trading is the Fast Track to Wealth

Think day trading is the key to riches? Think again. Here's a startling statistic from the last 20 years:

Miss the 5 best days in the market, and your returns could drop by 35-40%. Miss the 10 best days, and you're looking at a 50-60% decrease. Miss the 20 best days, and you've lost 80% of the market's potential returns.

Timing the market isn't just risky—it's nearly impossible. Instead, consistent, long-term investing is what builds real wealth.

*Source: J.P. Morgan Asset Management, “Guide to the Markets,” 2020.

Money Myth #2: Insurance is the Ultimate Wealth-Building Tool

For individuals with assets under $13.99 million (as of 2025), there are often smarter, more efficient ways to build and protect wealth than relying heavily on traditional insurance products.

While insurance can play a valuable role in a comprehensive financial plan, it shouldn't be your go-to solution for wealth-building.

Here's why:

1. High Fees and Mediocre Returns: These can significantly limit how much wealth you can grow over time.

2. Not an Investment Vehicle: Insurance is designed for protection, not growth, and should never be treated as an investment strategy.

Instead, focus on a balanced approach that includes diverse protective measures and sound investment strategies. This ensures you're maximizing your potential for growth without unnecessary limitations.

*Source: IRS Estate Tax Guidelines for 2025.

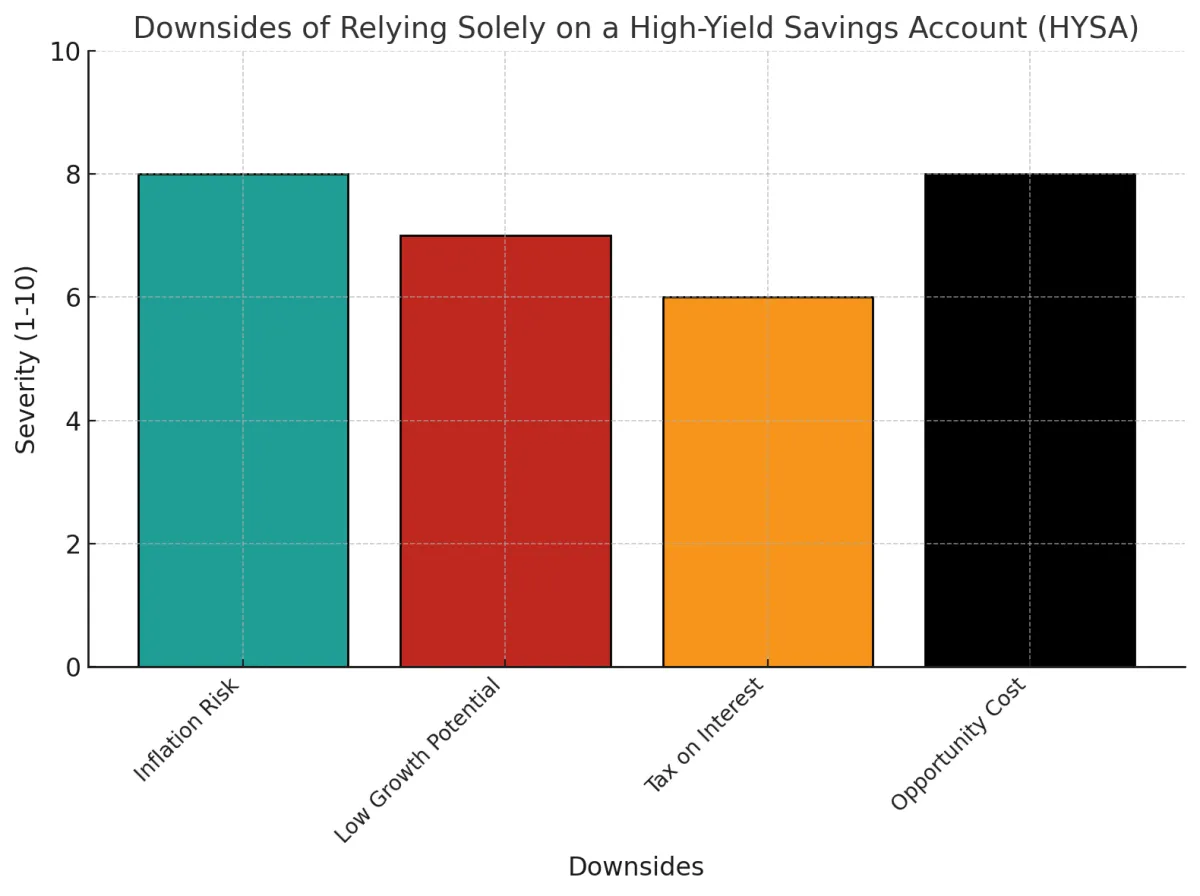

Money Myth #3: (HYSAs) Are the Best for Your Money

I see a lot of Social Media Influencers Say..."A high yield savings account is the answer to all of your problems!" Than they

(insert affiliate link here). Yes, a HYSA can help you make extra money, yet there are still problems to consider such as inflation risk, low growth potential when interest rates decrease, taxes on your interest, and the opportunity cost that you could possibly miss out on by not having your money in the proper investment strategy.

*Source: GoBankingRates, “The Downsides of High-Yield Savings Accounts,” 2023.

What Our Clients Are Saying: Real Experiences from People We've Helped

***Disclosure***

Unlike many "financial influencers" who are not subject to regulatory oversight, 369 Financial operates as a registered investment advisory firm and adheres to the strict marketing and testimonial rules established by the Securities and Exchange Commission (SEC). These rules are designed to promote transparency, integrity, and compliance in all client communications.

***About Testimonials***

The testimonials presented on this website reflect the individual experiences of select clients. They are not intended to represent the experiences of all clients and should not be interpreted as a guarantee of future performance or investment outcomes. To respect client privacy, we may use initials, anonymized details, or altered visuals in connection with these testimonials. No clients have been compensated in any way for their feedback or testimonials.

***Third-Party Reviews***

While the testimonials displayed on this website have been curated, additional reviews about our firm may be available on third-party platforms. We encourage you to search for “369 Financial” to access these independent reviews. Please note, however, that the testimonials featured on our website are separate from those found on third-party platforms and are presented here for informational purposes only.

***FREE BONUS CHAPTER***

By following these simple, actionable steps, you could enhance your financial literacy and build the confidence to make informed money decisions in as little as 30 days! These tips are the result of Josh's 12 years of experience in the financial industry, distilled into practical guidance so you can benefit from his knowledge without having to sift through countless investment books

Using This One Little Investment Calculator that will educate you to help determine whether an investment is worth purchasing or not (no more trusting "financial influencers" to make important decisions for you)

Stop Making Silly Mistakes These 10 commandments are inspired by insights from extensively researched and highly regarded investment literature, including principles discussed in 'The Intelligent Investor' by Benjamin Graham, who is widely recognized as Warren Buffett's mentor.

**you CAN'T find these on social media

Frequently Asked Questions

Who is Joshua Krafchick again?

Joshua Krafchick is an investment advisor with over $10 million in assets under management as of January 2025. He has provided financial guidance to clients across the United States. This statement does not constitute a guarantee of future performance, and individual client experiences may vary based on their unique financial situations and goals.

What's Included?

This guide offers practical wealth-building strategies designed to help you take actionable steps in your financial journey. Each strategy is presented in a clear and concise format to make complex financial topics—such as investing, tax planning, and managing debt—accessible and easy to understand. While these insights are crafted to empower you to grow wealth efficiently and confidently, they are for informational purposes only and should not be considered personalized financial advice. Individual financial needs and circumstances vary, and you should consult with a qualified advisor before implementing any strategies outlined in this guide.

Can a $9.63 guide really help me grow wealth?

The value of this guide lies in its ability to provide foundational knowledge and actionable insights to help you make informed financial decisions. While a $9.63 guide alone isn't a magic solution to wealth-building, it can serve as a starting point, offering tools and strategies to help you better understand your finances and take steps toward your goals. It's important to remember that growing wealth is a journey requiring consistent effort, informed decision-making, and often professional guidance. This guide is designed to complement that process by sharing clear, concise strategies for areas like investing, debt management, and tax planning. By applying the principles in this guide thoughtfully and consistently, and seeking professional advice where needed, you can build a stronger foundation for achieving financial success.

Is the information in the guide credible?

Yes, the information in this guide is based on proven financial principles, industry standards, and best practices designed to help individuals make more informed decisions about their finances. The content is drawn from reliable sources, including insights from experienced professionals, research-backed strategies, and established guidelines for investing, tax planning, and debt management.While the guide is crafted to provide accurate and actionable information, it is important to note that it is intended for educational purposes and is not a substitute for personalized financial advice. Individual circumstances vary, and for tailored guidance, we recommend consulting a licensed financial adivsor. By focusing on practical, research-based strategies, the guide aims to empower you with credible tools and knowledge to support your financial journey.

What's the catch? Are there hidden costs?

There’s no catch, and there are no hidden costs. The guide is offered for $9.63 as an accessible resource to help individuals start or improve their financial journey. The price reflects our commitment to making reliable financial information affordable and widely available. While the guide itself is comprehensive and packed with valuable insights, building wealth often involves additional steps, such as working with financial professionals or investing in tools and services tailored to your specific needs. However, these are decisions you make independently, and the guide does not include upsells or obligations for additional purchases. Our goal is simple: to provide a trusted, low-cost resource that delivers actionable strategies to help you take control of your finances.

Why should I trust this guide over free content online?

Here's a compelling and compliance-conscious response to that question: Why Should I Trust This Guide Over Free Content Online? In today’s world, there’s no shortage of free financial advice online—but not all of it is reliable or tailored to helping you achieve real results. This guide stands out because it’s curated with care by financial professionals who prioritize delivering actionable, trustworthy information. Here's why you can trust it:

Credible Sources: The strategies in this guide are rooted in proven financial principles and industry best practices, unlike some free online advice, which may lack accuracy or context.

Structured and Actionable: Instead of piecing together random tips from various sources, this guide offers a clear and concise framework, saving you time and helping you focus on what works. Focus on

Education: The guide is designed to educate, not sell you products or services. Its sole aim is to empower you with the knowledge to make better financial decisions.

No Clickbait or Hidden Agendas: Unlike much of the free content online, this guide isn’t driven by ads, affiliate links, or hidden motives—it’s about providing straightforward, reliable strategies. While free online resources can be helpful, they often lack the depth, credibility, or structure needed to make a meaningful difference. Investing in this guide gives you a resource you can rely on to support your financial journey.

What exactly will I learn from this guide?

The guide covers foundational financial topics such as:General strategies for building and managing wealth. Basic principles of investing and risk management. Tips for optimizing insurance, taxes, and loan payments. Guidance on creating a personal financial transformation plan. This guide does not provide specific investment recommendations or individualized financial advice.

Who is this guide for?

The guide is intended for individuals seeking to improve their financial literacy and gain a better understanding of wealth-building fundamentals. It is not a substitute for advice from licensed professionals, including financial advisors, accountants, or attorneys.

369 Financial| Copyright ©2025| All Rights Reserved

This site is not a part of the Facebook website and/or META Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc. and/or META Inc.

The results you see are the results of specific clients. We do not guarantee you will receive any specific results. You could get better results, worse results, or the same results. We only guarantee that we will give you our tools to help increase your knowledge of wealth building strategies or your money back.

Privacy Policy - Terms & Conditions

**At 369 Financial, LLC, we value transparency and customer satisfaction. To ensure a seamless experience, please review the following refund terms:

Eligibility: Refund requests must be submitted within 30 calendar days from the purchase date. Requests beyond this timeframe will not be considered. Refund requests must be sent to our official email at [email protected] with: Your full name, Order number, and Proof of purchase. Incomplete submissions may delay or invalidate the review process.

Limitations: Certain products or services may not qualify for refunds. However, we offer a free 30-minute consultation to address any concerns or dissatisfaction. If you have an issue, you can book your consultation directly through our website using our scheduling tool, ensuring a prompt resolution to your concerns without the need to email. The consultation fee would then be waived and/or if no resolution comes to terms, we can issue a full refund. Refunds for eligible items are subject to review and approval.

Refunds are processed at the sole discretion of 369 Financial. If you have questions regarding our refund policy, please contact us at

.

Past performance is not indicative of future results.